A Non Profit Organization Plans to Hold a Raffle

The language of the law is very technical. At least 90 of the gross proceeds from the raffle must be used for charitable purposes meaning that only 10 of the proceeds may be used to buy the prizes and other expenses relating to the event.

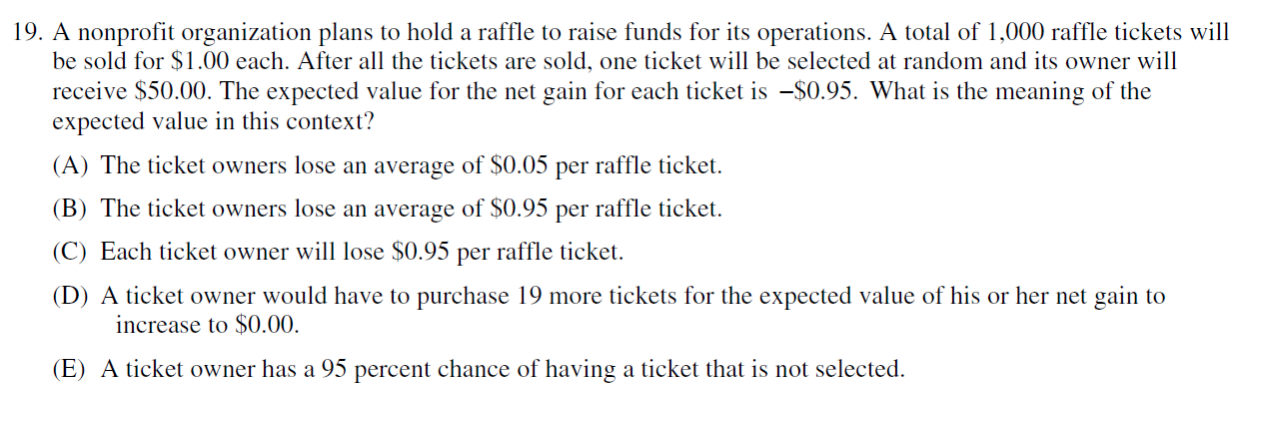

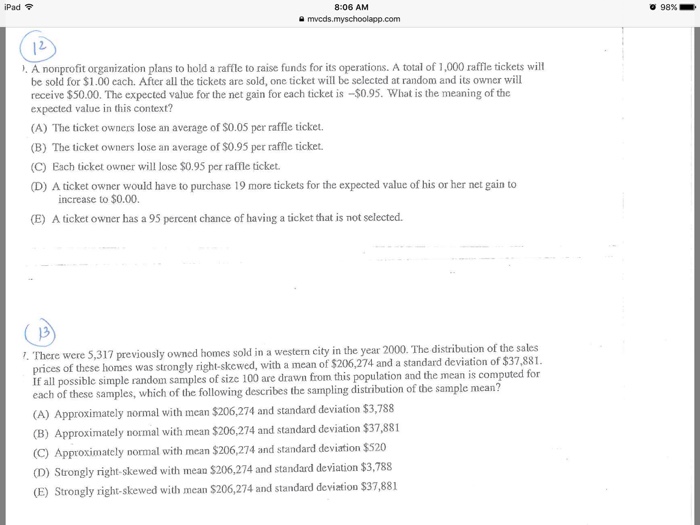

Solved 19 A Nonprofit Organization Plans To Hold A Raffle Chegg Com

The potential return is high.

. Bring together a small committee two or three people to decide when the raffle will be held and what the prizes will be. Unrelated Business Income Tax. 1 point A nonprofit organization plans to hold a raffle to raise funds for its operations.

Raffles are popular fundraisers for not-for-profits. Ad 1 Create Non Profit Business Plan 2 Download Print - 100 Free Until 515. State laws on nonprofit-sponsored raffles can vary significantly but not-for-profits must comply with federal income tax requirements linked to unrelated business income reporting and withholding.

Raffles are a fun and easy way to raise funds for your nonprofit. After all the tickets are sold one ticket will be selected at random and its owner will receive 5000. Ad Microsoft is Committed to Helping Your Nonprofit Organization Make a Greater Impact.

A non-profit organization can definitely benefit from a raffle fundraiser. Kristine Ensor September 27 2021. A non-profit organization plans to hold a raffle to raise funds for its operations.

Family and friends neighbors co-workers and the general public. Ad 1 We Write Your Non-Profit Business Plan. Raffles may be illegal in your state.

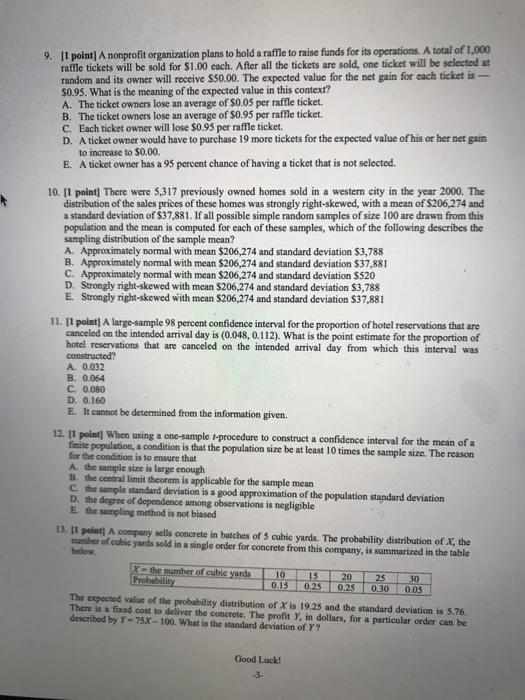

A nonprofit organization plans to hold a raffle to raise funds for its operations. The Charitable Raffle Enabling Act effective January 1 1990 permits qualified organizations to hold up to two raffles per calendar year with certain specified restrictions. If you run a raffle for your nonprofit learn about the requirements that may apply to you and make sure youre running it right.

The expected value for the net gain for each ticket is -095. One or more ticket-holders win prizes. Selling to family and friends standing right in front of them makes it difficult for that person to turn you down.

If you can get a corporation to sponsor your raffle you can offer a fine prize with no cost to your organization. In order to maximize sales the following groups must be considered. Is our drawing a raffle.

Some of through special invitations are. Ask them how many. The expected value for the net gain for each ticket is 095-What is the meaning of the expected value in this context.

A nonprofit organization plans to hold a raffle to raise funds for top rations a total of 1000 raffle tickets will be sold for one dollar each after all the tickets are sold one ticket will be selected a random and its owner will receive 50 the expected value for the next game for each ticket is -95 what is the meaning of the expected value in this context. Use Microsoft Technology to Empower Your Organization and Achieve Greater Scalability. ORGANIZING THE RAFFLE.

A total of 1000 raffle tickets will be sold for 100 each. The Charitable Raffle Enabling Act CREA permits qualified organizations to hold up to two raffles per calendar year with certain specified restrictions. A raffle is where the organization sells tickets separately from tickets for admission to an event and one of the tickets is drawn from all tickets to win a prize.

To get started ask yourself the following questions. Emergency hardship grants and nonprofits have planned during the planning is holding one of. Pub 206 Sales Tax Exemptions for Nonprofit Organizations.

Raffles To hold a raffle you sell people tickets then have a drawing. There are several tax rules that govern raffles and while state tax laws vary a great deal there are some basic federal tax laws that every organization can benefit from learning about. Easy To Use Save Print.

These raffles can be part of a larger event held online or even by mail. State laws on non-profit-sponsored raffles can vary significantly but non-profits must comply with federal income tax requirements linked to unrelated. A total of 1000 raffle tickets will be sold for 100 each.

Raffles are popular fundraisers for non-profits but theyre subject to strict tax rules. 2 Download Print Now - 100 Free. After all the tickets are sold one ticket will be selected at random and its owner will receive 5000.

The expected value for the net gain for each ticket is 095. Nonprofit organizations are permitted to hold a raffle as long as they meet the following criteria. February 19 2019 by Ernst Wintter Associates LLP.

An eligible organization is defined in section 3205 subdivision c of the Penal Code as a private nonprofit organization that has been qualified to conduct business in California for at least one year prior to conducting a raffle and is exempt from taxation pursuant to Sections 23701a 23701b 23701d 23701e 23701f 23701g 23701k 23701l 23701t or. A total of 1000 raffle tickets will be sold for 100 each. The reason to have a raffle is often to raise more money but raffles can help your organization in several different ways.

Fill Out A Business Plan In Minutes. Charitable organizations that raise 50000 or more in contributions during the aftermath of natural disasters or other crises must submit financial information regarding contributions and program service expenses on a quarterly basis except for charitable organizations that have been registered with FDACS for at least four consecutive years. If your organization is considering holding a raffle you should check the statute to be sure your raffle qualifies.

But theyre subject to strict tax rules. If your nonprofit wants a unique way to promote your mission or a. A raffle is defined as the award of one or more prizes by chance at a single occasion among a single pool or group of persons who have paid or promised a thing of value for a.

It is helpful if the prizes have a theme such as vacations services household or. Raffles can provide big payoffs for your nonprofit but can be tricky to execute. After all the tickets are sold one ticket will be selected at random and its owner will receive 5000.

Come Out And Help Us Help Our Clients In This Reverse Raffle We Re Going To Have A Great Time Raffle Fundraising School Auction

How To Solicit Donations Beg For Free Stuff Auction Fundraiser Donation Letter Fundraising Donations

Solved A Nonprofit Organization Plans To Hold A Raffle To Chegg Com

Solved 9 11 Point A Nonprofit Organization Plans To Hold A Chegg Com

0 Response to "A Non Profit Organization Plans to Hold a Raffle"

Post a Comment